The Banking industry, including retail banks and credit unions, wealth and asset management firms and corporate treasury divisions faces significant challenges.

Customers are expecting secure, answerable and quick-response platforms for their needs

Banks would rank reducing costs and improving customer acquisition as their topmost primacies.

Technology and internet have brought along cyber-crimes and security breaches

KoScan-Marketing Automation

Targets complete automation and personalization of messaging to defined segments or trigger messages based on user behaviour.

Know more

KoSync-Omnichannel communication

Financial services companies encompassing insurance, banks, crowdfunding and money transfers are using programmable communications to deliver a dynamic and engaging customer experience.

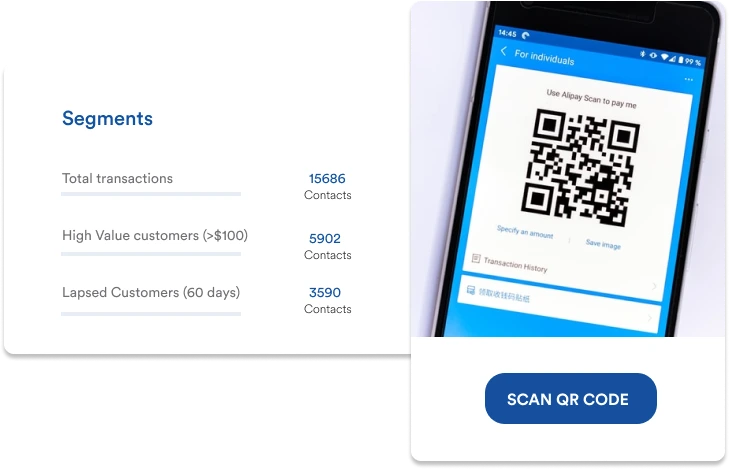

Know moreCustomize offers based on each customer’s product ownership and transactional data

Enhance sales by moulding offers according to each customer’s product sentiment and income

Powered by omnichannel AI engine, trigger communications on deposits, renewals and credit card limit augmentation.

Provide a seamless experience to customers at every touch point and life-cycle stage including cognizance, consideration, procurement, servicing and loyalty.

Deliver reminders at exactly the right moment to reach out to both new and established customers

Follow individual leads and track their journeys to improve upon product search advertisements

Evolve with evolving customer habits by integrating voice assistants, chatbots, IoT devices and more into omni-channel banking journeys.

Build upon target audiences with advanced segmentation module that automatically gathers and derives hyper-valuable metrics, like lifetime value, balance, marital status, loans, individual propensities and more – from across data sources and campaigns.

Discover new potential customers using AI-driven look-alike targeting along attributes such as location, transactional history, offer propensities, income and more.

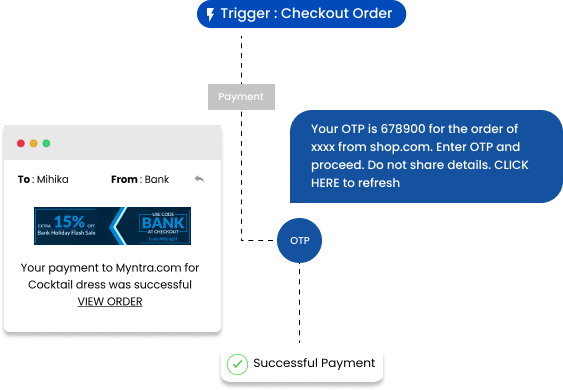

Add another layer of security for customer accounts using one-time passwords and two-factor authentication tools

Verify using OTP SMS on registered mobile numbers and email IDs.

Trigger real-time notifications for validating transactions and confirming suspicious activity for customers in just a few clicks

Align regulations and mandates with your threat detection and response system.

About

One stop centralized messaging gateway to handle PAN India messaging service needs across branches.

Managing cross platform messaging needs

Single stop solutions for inbound and outbound messages

An initiative by Korero to enable seamless banking solutions to unpenetrated customers.

Impact

Messages per second

SMS broadcasting daylong capability

Archival facility ensuring zero data loss

Yield

Accessible and quick messaging services

Single platform to handle PAN INDIA SMS needs, enabling ability to send all kind of messaging

In-time availability of banking services

Banking services through multi-channels

Seamless integration across branches

Benefits

Robust service with scalability to meet future needs using secure authentication system. Adhering to regulatory and internal security audits.

An initiative by Korero to enable innovative banking solutions to the unpenetrated customers.

over any communication channel they want.

Contact An Expert